Krones Group Annual Report 2024

“By investing in sustainability, digitalisation, product innovation, internal processes and employees, Krones is laying the foundation for achieving its ambitious medium-term goals by 2028.”, Christoph Klenk, CEO

Strategy and management system

The past financial year has demonstrated once again that Krones is well positioned in stable markets. Despite the challenging macroeconomic landscape, the willingness of the beverage and liquid food industry to invest remained at a robust level. The company successfully used the favourable overall market trend for further profitable growth. At the same time, we had to process an extremely large order backlog on schedule without compromising on quality, while significantly reducing delivery times. That we achieved this in 2024 is down to the great adaptability and motivation of the entire Krones workforce.

Megatrends make for stable strong demand – despite global uncertainties

We are also planning with realistic optimism for the future. The stable -growing and less cyclical food and beverage market benefits from several megatrends. Global population growth, the rise of the middle classes in emerging markets and the continuing increase in urban populations, particularly in emerging and developing countries, are all driving demand for packaged -beverages. Sustainability is another factor that supports demand for Krones products on a long-term basis, because customers need to achieve their ambitious climate targets and save costs. As an internationally leading provider of -resource-efficient beverage filling and packaging technology and a process technology and intralogistics solution provider with a comprehensive product and service portfolio and global service network, Krones is ideally placed to capitalise on the opportunities in this attractive market.

Despite the positive outlook for our markets, we are careful not to lose sight of the short and long-term risks. There are a number of geopolitical and economic uncertainties. At worst, these can have a negative impact on supply chains and on energy and commodity prices – and ultimately on the global economy. Potential trade conflicts between the major economic blocs comprising the US, China and Europe would severely impact global trade and weaken global economic growth. Climate change and the availability of natural resources are long-term societal challenges. The resulting issue of sustainability offers opportunities for Krones.

To achieve the profitable growth essential to Krones’ future success, a series of strategic measures are to be implemented consistently and sustainably in all three segments.

Improved and more flexible cost base and organisational structure

One of our core strategic priorities is to further improve Krones’ cost base and organisational structure and to reduce fixed costs as a percentage of total costs. This will make us more adaptable and resilient in the more volatile economic environment. To this end, Krones is accelerating, digitalising and automating internal processes and workflows. We are increasing efficiency by modernising our existing globally standardised IT landscape for the entire value chain. The company is also implementing cost improvement programmes in almost all areas.

Expanding the global value chain also helps significantly in improving cost structures. Global procurement and production with built-in redundancy make Krones more flexible and more resistant to crisis scenarios such as protectionist policies, regional supply chain disruptions and production stoppages. After -successfully establishing a production site and the associated supply chains in Hungary, the company is now going to significantly expand the Taicang site in China. Krones likewise plans a new production site in the fast-growing Indian market.

While the company is also investing heavily in its sites in Germany, we intend to expand the proportion of international value creation within the Krones Group over the coming years.

Disciplined pricing strategy is the basis for profitable growth

Alongside cost structure, another key profitability factor for Krones is selling prices. By delivering innovative solutions that provide customers with added value and by reliably completing projects for our international customers, we can succeed at offsetting any cost increases with higher prices. Despite ongoing intense competition, we are adhering to our disciplined pricing strategy. The large order backlog gives us the latitude needed to uphold our price discipline.

Innovation secures our company’s future

Innovations are crucial to Krones’ long-term success. High-quality, technologically leading products and services are key to maintaining good levels of price realisation. For many years, Krones has therefore invested an above-average 4% to 5% of revenue in research and development (R&D).

Innovations at Krones must provide measurable added value to customers and help them achieve their goals. We work in dialogue with our customers to develop solutions based on their needs.

An example is the line of the future, in which we have combined numerous innovations and which we will be presenting at drinktec in 2025. The line of the future was primarily developed on the basis of detailed customer feedback from drinktec 2022. It enables Krones to create even more closely integrated solutions and new business models along the entire line life cycle.

Krones’ focus in innovation is on sustainability, digitalisation and system solutions. We present our R&D strategy and a selection of our innovations from the reporting period on pages 67 to 75.

Solutions beyond tomorrow – successfully taking responsibility

With its corporate vision of “Solutions beyond tomorrow”, Krones aims to contribute to three key challenges confronting humanity: Combating climate change, feeding the world, and ensuring responsible use of packaging materials. This gives rise to the company’s strategic orientation, with clear focus on the core areas of sustainability, service quality and digitalisation. These three areas also determine the strategic orientation of our three segments.

Krones sets net-zero emissions target for 2040

In “Solutions beyond tomorrow”, Krones has committed to making a significant contribution to combating climate change and conserving resources. The group has adopted the strategic goal of reducing its greenhouse gas emissions along the entire value chain to net zero by 2040. This places Krones Group’s net zero strategy in line with the 1.5-degree Celsius target in the Paris Climate Agreement.

For the implementation of its climate strategy, the company has also set milestones through to 2030. The company aims for an 80% reduction in operational greenhouse gas emissions (Scope 1 and Scope 2) and a 30% reduction in Krones’ upstream and downstream value chain emissions (Scope 3) by 2030 relative to 2019. At the end of the 2024 financial year, we stand at around a 52% reduction in Scope 1 and Scope 2 and just under 15% decrease in Scope 3.

Krones supports customers with their climate targets – sustainability the most important innovation and growth driver

Krones is not alone in adopting ambitious climate targets: our customers have similarly challenging climate targets of their own. These drive rapidly growing demand for machines, systems, lines and entire beverage plants that save valuable resources and reduce carbon emissions. The company supports customers in achieving their climate targets. Our TÜV-certified energy and media-efficient enviro product range verifiably and measurably saves customers valuable resources and thus costs in operation. Beverage producers have long benefited from the lower energy and resource consumption of our machines and lines. The share of enviro machines and systems in the order intake exceeded the 50% mark for the first time in 2023. Krones expects this proportion to grow in the coming years.

Furthermore, our sustainability consultants assist customers in quantifiably and demonstrably reducing their ecological footprint, both for existing systems and for new lines.

Closing the loop to cut emissions and plastic, and avoid waste

Plastic is a valuable resource that should not end up as waste in the oceans or on land. If we are to solve the global problem of plastic waste, we need to move away from high-quality single-use plastics and towards a circular economy. This makes it possible to reduce emissions from the production of plastic packaging, become less dependent on fossil resources and avoid waste.

Over the next few years, many beverage producers will significantly increase the amount of recycled PET (rPET) in their bottles in order to reduce their reliance on virgin PET, which is a valuable resource. Krones will provide its customers with the best possible support in terms of the circular economy, from material-saving packaging design, preform production (injection moulding) and bottle production (stretch blow moulding) through filling, labelling and packaging to the recycling of used plastic bottles and their reuse in the food industry.

We completed the recycling loop by acquiring injection moulding machine manufacturer Netstal in the reporting period, and now have all of the main products and technologies needed to produce new PET bottles from used PET bottles in what is called bottle-to-bottle recycling. In this way, Krones is able to maintain PET in an environmentally friendly and sustainable cycle.

Plastics recycling: independent and future-ready

As well as for PET (bottle-to-bottle recycling), Krones recycling technology can also be used to recycle other high-quality packaging plastics and thus reduce the volume of plastic waste. To realise the full potential of our recycling technology, we spun off “Krones Recycling” as a separate subsidiary in mid-2024. This enables us to respond even more rapidly to new developments on the recycling market. Alongside PET, there has also been a sharp rise in demand for polyolefin recycling solutions. In the USA in particular, recycling companies are currently investing heavily with regard to polyolefins (HDPE, LDPE, PP and PE).

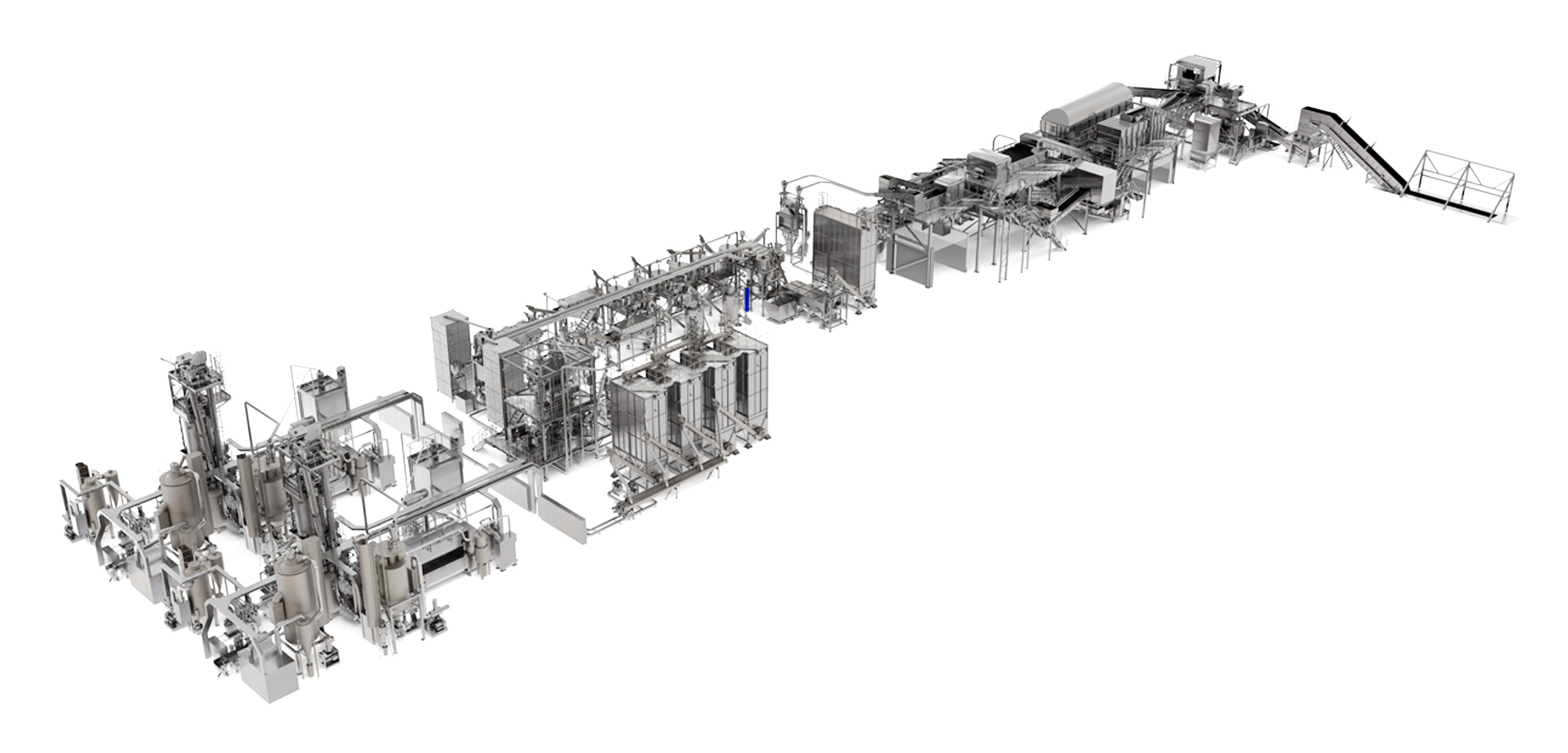

Krones recycling system

Krones Recycling – a standalone subsidiary since mid-2024 – covers the entire plastics recycling process from baling to food-grade flakes.

The washing, sorting and decontamination modules can also be retrofitted as individual machines in an existing line.

Alternative proteins: feeding the world in a sustainable and climate-friendly way

The world’s high consumption of animal protein generates massive greenhouse gas emissions and uses enormous quantities of fresh water. In order to feed the world’s population in a sustainable manner without placing an undue burden on the planet, the production of high-quality plant proteins as an alternative to animal proteins is becoming increasingly important. Krones intends to take advantage of opportunities in this emerging medium to long-term market – which analysts from Nester Research expect to grow by 11% annually worldwide between 2024 and 2036 – and to contribute its decades of experience in process technology.

In the already established market for plant-based dairy alternatives (soya, oats, nuts, etc.), Krones has focused on the production of oat milk, where the company supports producers with its extensive dairy industry expertise and full range of process technology. In the production of solid plant-based proteins, Krones draws on decades of experience in fermentation. Proteins produced by fermentation can be combined with other ingredients and further processed to replicate meat, egg or dairy products. With its products and services, Krones is well positioned in the fast-growing market for alternative proteins, and aims to achieve above-average growth here in the medium term.

The digital beverage plant saves valuable resources and is the basis for future service business

To remain competitive, beverage and food manufacturers must produce as efficiently and flexibly as possible. The digitalisation of production plays a key part here, helping to identify potential for fine tuning, save resources and prevent disruptions and stoppages. Another advantage for customers is that as digitalisation increases, the need for production labour decreases. This helps to alleviate the skilled labour shortage and save costs.

When it comes to the digitalisation of beverage plants, Krones benefits from its line and factory expertise – knowledge of how to perfect the interoperation of numerous individual machines and lines. The company has already digitally connected more than 200 lines for customers and provides the related digital products and services in various forms. These create added value for customers, either through enhanced product safety, more reliable production or reduced total cost of ownership (TCO).

Krones’ goal is to provide digital support throughout the entire life cycle of a machine or line and to profit more from services. An important building block in this regard consists of our individually configurable and coordinated service packages known as Modular Service Agreements (MSAs). With over 1,000 MSAs now in place, Krones supports plant operators in measurably improving production efficiency and achieving clearly defined targets. Customers benefit with fixed, predictable costs. A contact person at Krones analyses and interprets the data collected by the digital tools and shows the line operator possible measures for improving the line’s performance.

At the beginning of 2025, the first “Lifecycle Alliance” line will go into operation, with Krones assuming full responsibility for service and the line’s performance – on the basis of digital services. With the service agreements, which also include the globally available LCS products, Krones aims to increase customer loyalty and generate a stable long-term revenue stream.

Approximately 1,500 people are dedicated to digitalisation initiatives within the Krones Group. At “Krones.digital”, around 600 software and IT engineers now work exclusively on the development of digital products and services. In the medium term, we plan a significant further expansion of this unit with the addition of around 100 specialists per year. Furthermore, some 100 service professionals provide customers with 24/7 support at six digital service centres around the world.

We also aim to reap the benefits of digitalisation within our own company. Numerous work operations and processes are accelerated and automated using digital tools, including artificial intelligence (AI). This significantly reduces internal and external processing times and improves efficiency and customer satisfaction.

Customer proximity: expansion of the service network and further internationalisation

The practical implementation of our digital and other services is the job of our approximately 3,000 local service technicians in over 70 countries around the world. With their factory and line expertise, they respond quickly and directly to customer needs – a key factor in long-term customer satisfaction.

- Over 6,000 service staff worldwide

- 3,000 service technicians

- 1,200 production and supply chain experts

- 1,800 technical support and back office staff

- On-demand global spare parts supply

- Digitalisation for next-level service

In addition to services, our strategically located LCS centres enable us to quickly deliver spare parts to operators around the world. A long-term growth driver for the attractive LCS business is our growing installed base of machines and lines. As in past years, Krones also intends to further increase the proportion of Krones-supplied managed lines.

In order to meet the growing demand for high-quality service, Krones will continue to invest heavily in the expansion of the sales and service organisation. The focus here is on international markets, where growth rates will remain above average. In particular, the Asia-Pacific region and Africa are expected to see the strongest growth over the long term. In the reporting period, the company once again increased the size of its workforce in the international regions shown in the table by 10.2% to 7,115 employees.

To further expand our highly qualified service units, we have launched targeted activities and projects as part of the onward evolution of our employer brand in order to find, train and retain suitable service technicians worldwide. Our goal is to grow the international service team by around 100 employees each year.

Strategic focus in the segments

Filling and Packaging Technology

PET: ongoing strong demand

Demand for PET lines remains at a high level. PET continues to be very popular with end consumers as a packaging material for beverages, and is growing faster than other forms of packaging. PET bottles are lightweight but sturdy. They have a relatively small carbon footprint and are comparatively inexpensive. Our PET lines thus make an important contribution to providing the world with a sustainable and affordable supply of beverages, fully in line with our corporate vision.

At drinktec 2025, will be presenting the line of the future, a highly innovative PET line. With this system, we will set new standards of sustainability, digitalisation and efficiency while consolidating and extending our lead in PET filling and packaging lines.

Netstal acquisition a major strategic milestone

Following the acquisition of Netstal Maschinen AG, a leading manufacturer of injection moulding machines for the beverage market (PET preforms and closures), Krones has been able since mid-2024 to offer all technologies required for closed-loop PET solutions – a notable unique selling point relative to the competition.

A further benefit of the Netstal acquisition is that with its injection moulding technology for medical applications and thin-wall packaging, Netstal also supports Krones’ strategy of diversifying into the medical/pharmaceutical market and the food and body care sectors.

Krones is ideally positioned in the recycling of used plastic bottles with Krones Recycling, a separate subsidiary established in July 2024, and with the innovative systems in the Krones Recycling portfolio. This area is set to grow significantly faster than the segment as a whole in the coming years.

Aseptic lines and cans also contribute to growth

The market for aseptic filling in PET containers also presents good growth opportunities. Demand will stay particularly high in the USA. There, numerous lines are still based on the extremely energy-intensive hotfill process, in which bottles are filled aseptically under heat. Many US beverage producers will increasingly switch to technologically advanced and sustainable aseptic systems that save PET packaging material and energy and can also use recycled PET. This will significantly reduce operating costs, the carbon footprint and plastic usage. Another advantage of our aseptic filling technology is the energy and media-efficient Krones sterilisation process, which requires no water.

Cans have become a very popular packaging choice in recent years. Krones picked up on this trend early on and is the global market leader in the filling of beer and soft drinks in aluminium cans. Consumers appreciate the fact that cans are convenient and space-saving, and that their contents cool quickly. Aluminium beverage cans are also the most recycled form of beverage packaging in the world. Because they are made from a single material, they can be easily recycled almost indefinitely without any loss of quality. Cans are consequently a popular, recyclable product that contributes significantly to resource conservation. Krones aims to expand its leading market position here with resource-efficient, flexible and hygienic canning lines.

Across the core segment, we also plan to continue expanding the life cycle service (LCS) business. This is targeted to grow faster than the installed base of machinery. To this end, the company will continue to invest in its service network and digitalisation.

Process Technology

Diversification increases profitability and resilience

The Process Technology segment is making good progress with its diversification strategy. Technologies for the production of plant proteins, energy-efficient solutions for beverage production and water treatment systems continue to gain in importance. Demand for these technologies will grow at above-average rates in the medium to long term, driven by the global megatrends of carbon reduction and water scarcity.

Revenue and earnings growth in Process Technology will also be supported by the expansion of the LCS and components business. The latter is increasingly benefiting from the 2023 acquisition of Ampco Pumps in the USA. Ampco is able to benefit from Krones’ global selling capacity. The components business with Evoguard valves and pumps can capitalise on Ampco’s excellent sales channels in North America and was rounded out by the acquisition. The Process Technology segment will also continue to optimise its cost structure by continuously expanding its global footprint, particularly in India, and through synergies between the various companies internationally.

Intralogistics

Market with significant potential

The market for automated warehouse logistics is expected to grow faster than the global economy in the medium and long term. The market is driven by rapidly growing demand for fast and efficient order processing. The Intralogistics segment, with our subsidiary System Logistics, benefits from the dynamic market with innovative and sustainable solutions. As well as saving energy and reducing operating costs, our automated products increase efficiency and reduce the number of operating personnel required, thus helping to counter the effects of labour shortages.

System Logistics will bolster the segment’s profitable growth with automated order-picking solutions, expansion of the service business and supporting software tools. In addition, the company will continue to internationalise its intralogistics business and increasingly extend it to areas outside of the beverage and liquid food market, such as food wholesalers and the animal food trade.

Strong finances increase resilience and enable future investment from own resources

Thanks to the very positive business performance and a free cash flow (before M&A activities) of €292.5 million in the reporting period, Krones has further strengthened its capital and financial resources. At the end of 2024, Krones had an equity ratio of 40.5% and a net cash position of €439.9 million. In addition, the company has around €850 million in undrawn credit lines. This strong financial and capital structure gives the company the necessary stability and security in today’s unpredictable political and economic landscape. Its comfortable equity and liquidity base also enables Krones to make strategic investments in growth and in the future from internal resources and thus further strengthen its competitiveness.

Krones will continue to spend some 4% to 5% of revenue on research and development. In addition, the company plans capital expenditure of around 4% of revenue in the coming years (2024: 3.4%). This spending will go into replacement investment, projects to improve efficiency within the company, expansion of the global footprint, growth initiatives and intangible assets such as software. Internal sustainability projects (Scopes 1 and 2) continue to account for a notable proportion of capital expenditure.

Acquisitions remain part of Krones’ strategy, with the short-term emphasis on the rapid and successful integration of recent acquisitions. When identifying potential future acquisitions, we focus on medium-sized, profitable companies that complement the existing portfolio technologically and regionally or provide access to markets beyond the beverage and liquid food industry.

Following the acquisition of Ampco Pumps in 2023, we continued to implement our acquisition strategy in the reporting period. Through the acquisition of the Swiss injection moulding machine manufacturer Netstal, Krones can now offer its customers all machines, lines and services for the complete PET packaging cycle, thus underscoring its pioneering role in sustainability and the circular economy.

Krones remains committed to sharing its success with shareholders through dividends. The company’s dividend strategy is to distribute 25% to 30% of consolidated net income to shareholders, although in recent years it has aimed for the upper end of this range.

Optimising working capital and increasing free cash flow and ROCE

Key financial performance indicators for Krones alongside revenue and EBITDA are free cash flow and return on capital employed (ROCE). To achieve our ROCE target of over 20% by 2028 (2024: 18.2%), we will increase EBIT, invest with a view to profitability and further optimise working capital in the medium term. The company has taken various steps to relieve working capital for this purpose. Lower working capital has a positive effect on ROCE.

Working capital also significantly influences the development of free cash flow, which is an important parameter. Less working capital tied up in the operating business leaves the company more liquidity for other purposes.

Krones sets medium-term targets to 2028

The stable market environment and the continued robust demand for our products and services make us confident that Krones will continue on its profitable growth path in the years ahead. On this basis, in July 2024, the company adopted ambitious targets for the period up to 2028.

The company plans to increase consolidated revenue to around €7 billion by 2028 (2024: €5.3 billion). Profitability is also set to improve. The mid-term target for the EBITDA margin is between 11% and 13% (2024: 10.1%). For the third financial target, return on capital employed (ROCE), Krones is aiming for more than 20% by 2028 (2024: 18.2%).

Alongside the financial targets, Krones also pursues other strategic group targets. These are summarised in the following table:

The Krones team: the most important success factor for sustained positive business performance

Krones’ employees are and will always be the foundation of its future success. The entire Krones team has done an outstanding job over the past few years, proving that they can adapt quickly and flexibly to changing conditions. Our employees have worked hard to earn our customers’ trust in Krones’ reliability. Customers thus cite Krones employees as a key reason for a positive decision to buy. The team spirit, expertise, creativity and commitment of the Krones workforce make the company resilient and successful.

To continue attracting motivated and well-qualified talent for Krones – despite the global shortage of skilled workers – we have enhanced our employer brand in the reporting period to highlight what makes Krones special. Our employer brand, which we have aligned with our vision of “Solutions beyond tomorrow”, is designed to attract new talent and strengthen the loyalty and motivation of the existing workforce.

In the coming years, Krones will add to its workforce, particularly in IT, software and service, and also in emerging and developing markets.

In “Solutions beyond tomorrow”, we have developed an ambitious vision that extends far into the future. In order to make this a reality, we need a clear strategy and also a team that will remain as strong in the years and decades to come as it is today.

Financial performance indicators

Krones’ management primarily uses the following most significant financial performance indicators to steer the group and its three segments:

- Revenue growth

- EBITDA margin (earnings before interest, taxes, depreciation and amortisation as a percentage of revenue)

- ROCE – return on capital employed – the ratio of EBIT to average net capital employed in the past four quarters. Net capital employed is defined as non-current assets (excluding goodwill and financial assets) plus working capital.

In order to strengthen our market position and utilise economies of scale, we will continue to generate profitable growth in all three segments in the medium term.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) is a key earnings performance indicator. Profitability, measured as the EBITDA margin (earnings before interest, taxes, depreciation and amortisation as a percentage of revenue) is among our key targets and metrics. The EBITDA margin indicates the company’s profitability in relation to revenue, irrespective of the tax rate, financial income/expense and depreciation and amortisation.

Since the 2022 financial year, our third performance indicator has been ROCE (return on capital employed), calculated at Group level. This is the ratio of EBIT (earnings before interest and taxes) to average net capital employed in the past four quarters. ROCE is a very important profitability indicator for the capital markets. Return on capital employed shows investors how efficiently the company makes use of capital. Until the 2021 financial year, our third key performance indicator was working capital as a percentage of revenue.

Other financial key performance figures

In addition to the above, further important performance indicators for Krones are free cash flow (cash flow from operating activities less cash flow from investing activities) and the working capital to revenue ratio. We take further guidance from the development of EBT (earnings before taxes) and the EBT margin (EBT as a percentage of revenue).

Non-financial performance indicators

In addition to financial performance indicators, non-financial targets are also firmly embedded in Krones’ corporate strategy. These are set out in detail in the non-financial statement (pages 76 to 178). Sustainability is an area of major importance and is also the focus of the Krones corporate vision.

Key non-financial performance indicators:

- Percentage of women in management positions

- Greenhouse gas emissions (Scope 1, Scope 2 and Scope 3)

- Water consumption

- Hazardous waste

- Work-related accident

As part of the Krones Group’s sustainability targets, which the Executive Board officially adopted in the 2020 financial year, the company has set ambitious emission reduction targets along the entire value chain.

- We aim for an 80% reduction in our own carbon footprint (Scope 1 and Scope 2) by 2030, relative to the 2019 baseline.

- For Scope 3 emissions – which are significantly higher and are mainly generated by the operation of our machines and lines at customer sites – we are targeting a reduction of 30% over the same period, again with 2019 as the baseline.

Additional sustainability goals are as follows:

- The Krones Group is committed to a 10% reduction in hazardous waste and water consumption by 2030, with 2020 as the baseline.

- We will reduce both work-related accidents and the resulting lost days per million hours worked by 30% across the Krones Group by 2030, compared to the 2020 baseline.

- The company aims to increase the percentage of women in management positions to 20% by 2030.

Scroll down and click to read parts of the annual report in HTML